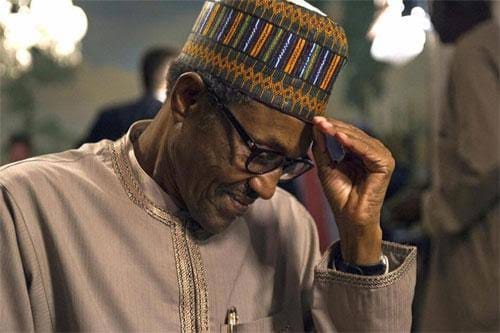

Escalating drug prices in Nigeria: Post-subsidy removal

By Abdullahi D. Hassan Nigeria is described as the most populous black nation in the world, with over 200 million inhabitants, Africa’s biggest economy, and endowed with variant mineral deposits…