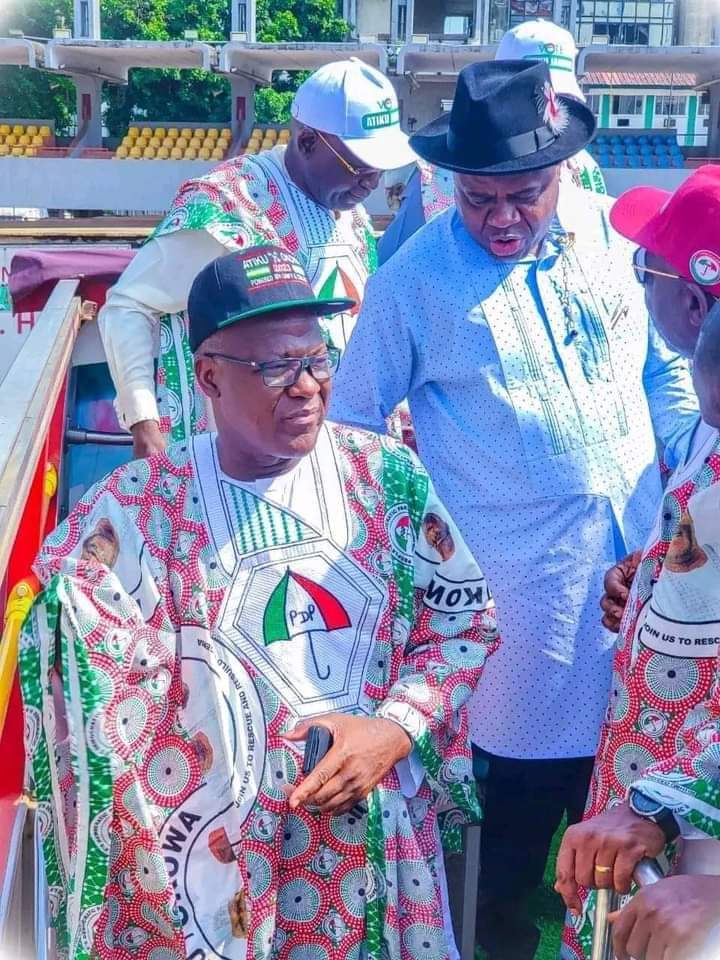

Dogara alleges massive vote-buying in Bauchi

By Muhammadu Sabiu Yakubu Dogara, a former speaker of the House of Representatives, alleges that there was widespread vote-buying yesterday during the gubernatorial and House of Assembly elections in some…