By Bin Isah

Of all events, death stands the best chance to hold the most central attention. It’s gripping, and its grasp strong. It resembles gravity, but its force is more powerful. And it always provokes shock, pain and grief. And no matter the frequency of its happening, it is still not a normalcy. Upon its occurrence, people will respond with the same reaction as ever before. Allah SWT put it as a test, a warning and a path to the final home. But some deaths hit harder than some, and some leave deeper scars than the ordinary.

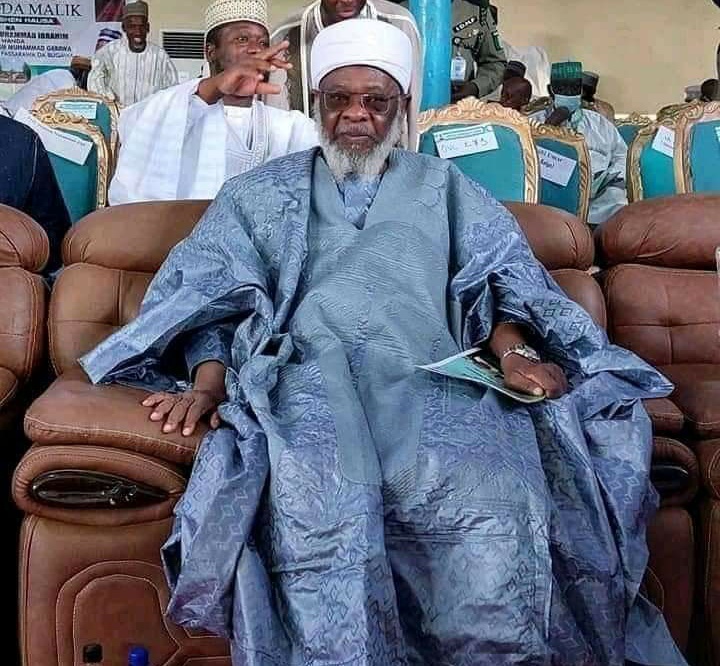

On 7th of January, death had dawned upon us with its darkness. It took a light, that is what knowledge represents. A knowledgeable mind of higher erudition, a paragon of wisdom and virtue, an epitome of Islamic scholarship and understanding, Dr Ahmad Bamba, BUK, Kala Haddasana, is gone. And that means a chasm has been created, a gap that can never be refilled.

When I first heard him in our home in my more younger days, I asked about him. I was curious to know, for something about him was indeed captivating. An elder brother of ours that used to bring his audio tapes to our abode said he was a teacher to Mallam Ja’afar. That’s the description that cut a long story short. We already knew Mallam Ja’afar, so he was the teacher of teachers, a scholar that produces scholars.

Dr Ahmad Bamba, was said to have appeared as a public preacher for three decades, that is, since his return from the Islamic University of Madina in 1991. In these periods, no any occupation had seduced him away from his devotion to his Islamic teaching and preaching. And this long time of service, on the path of Allah SWT and for the guidance of the people, is sufficient to provide a picture of a man with purpose, dignity and piety. His pleasure in the work had penetrated him so much that no any stress could disrupt it.

Even at 82, Dr Ahmad did not retire. His life had no any ambition but Da’awa service, informing people on how to live in the light of Divine Pleasure under the guidance of His Prophet, Muhammad SAW. He believed that people need to lead a righteous life, and in as much as he breathed he would have no any other endeavour. And it is clear that his life has been a blessed, graceful one. The grace that Allah SWT placed in his work is apparent. He lived with his faculties in function, and with such a vigor that scares even the energetic young. His thinking remained acute, his voice sounding, and his movement full of life. It’s the blessing of Allah SWT.

And what is more wonderful about Dr Ahmad Bamba is the way his style touches upon the tastes of all ages. The young and the old, men and women will tell you they like him. His Hausa language is original, his explanation lucid, and his treatment of matters loose, and that makes people listen to him with passion. He has a special knack for making the complex simple, and his grasp of social experience puts him at another edge. And his preaching is not boring, it’s full of fun.

Whoever remembers Dr Ahmad BUK will tell you that it’s by his reading of “isnad” he recognises him. In fact, “Kala Haddasana” is another name for him. Here is the man that spent his best time at service to the Prophetic Sunnah, teaching people the times and life of the Prophet SAW, as exemplified in his words and actions, at home and at away, making the Prophet SAW more accessible to the seeker. The prophet’s relationship with Allah SWT, with his wives, with other people across different paths and faiths, etc, Dr Ahmad leaves no any aspect without a word on its meaning and value based on the acceptable accounts.

The most popular, most reliable and well documented six books of hadith that are called “kutubus sitta” have been taught by him, and with such a precision that goes within the public purview. And Scholars that learn from him never miss his technical analysis of the . Both the public and the scholars are carried along, and this could only be done by an exceptionally phenomenal teacher. And Dr Ahmad is one. And that’s the greatest achievement that no one could beat him in its regard. He is the only champion in his league. His “Mawatta Malik” is even published into a voluminous, enriching book, and in the living language of the people, and that shows that his legacy will dance to the music of time.

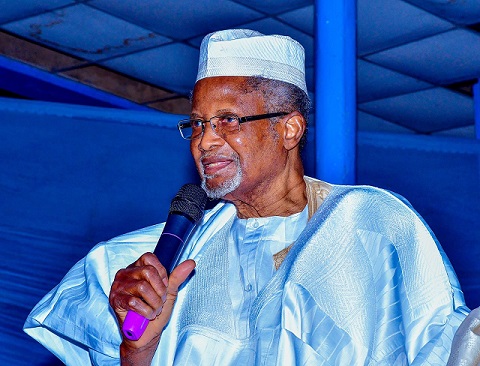

Sheikh Muhammad bin Othman observed a moving Khubta, with tears breaking out of his eyes, and his breath choking him at throat. He recounted the condition in which he found Dr Ahmad at hospital, and described it as the most traumatizing one, but what Allah SWT decreed is the most prevailing. He said, “I saw knowledge before me, lying on the bed —ga ilimi kwance. Inna Lillahi Wa Inna Ilaihi Rajiun.” I could not do anything, we could do nothing about it, he added. “Dr was not even conscious. I left with a heavy heart, and the whole night I couldn’t sleep well.” In the morning, around 10:58, he was informed that Dr Ahmad was no more. Inna Lillahi Wa Inna Ilaihi Rajiun.

The death of Dr Ahmad recalls to life the life he has lived, and that its mark shall remain upon the mind of the living. It is however a void that stimulates remorse at the recess of people’s hearts, because such a loss is irreplaceable. Though his knowledge shall continue, and his wisdom be applied in the art living, discussing and teaching, his absence will leave many questions unanswered and many problems unsolved when they surface. There are gifts that leave with those that bear them. And Dr Ahmad is gone.

While being interviewed after the funeral prayer, Dr Sani Umar R/Lemo described the loss as huge, a bleak sign that knowledge is precipitating. He said that people will indeed feel the emptiness occasioned by Dr Ahmad’s leaving. Of all their lives, they know Dr Ahmad with teaching and preaching. He is a guide, a father, a guardian, as Sheikh Dr Abdallah G/Kaya put it. To all scholars, he is a role model, an example to be emulated. And scholars from different parts of the world have expressed their sadness over the loss. And to Allah SWT we all belong, and to him is our return.

I was at the graveyard, close to his grave, and what I saw and felt in that moment will stay with me for a longest while. In fact, the entire experience shall be memorable. People were swallowed by grief, held by remorse and chained by love. Upon the arrival of his body, I found myself frozen with words and motions. I remained silent, only feeling the sensation of the pain that engulfed me. I shed tears, and over the fact that Dr Ahmad was truly gone. Here is a knowledge in shroud, a remarkable personality buried, a pious scholar being laid to rest. Only “Allahu Akbar” and “Inna Lillahi Wa Inna Ilaihi Rajiun” that filled the air held me, but I could have fallen aground. Finally, Dr Ahmad was in his grave, closed and gone, forever. Inna Lillahi Wa Inna Ilaihi Rajiun.

Bin Isa writes from Kano State and he’s a desciple of the late Dr Ahmad Ibrahim Bamba.