By Uzair Adam

The Republic of China has declared firm support for the Nigerian government as it “leads its people on the development path suited to its national conditions.”

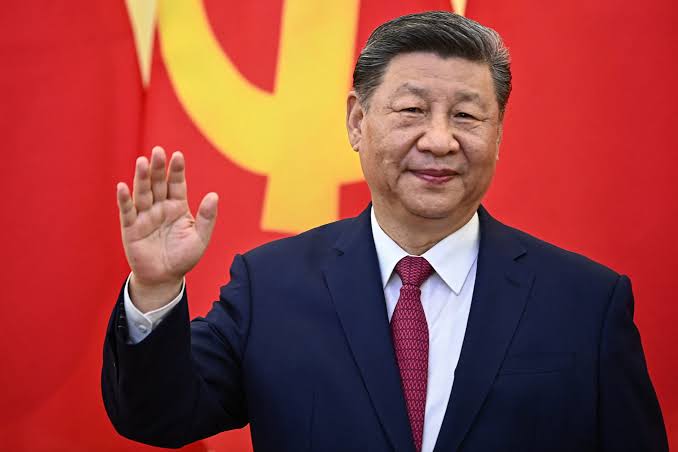

Speaking at a news conference on Tuesday in Beijing, Spokesperson of China’s Foreign Ministry, Mao Ning, said that “as Nigeria’s comprehensive strategic partner, China firmly opposes any country using religion and human rights as an excuse to interfere in other countries’ internal affairs or threatening them with sanctions and force.”

Ning made the remarks while responding to a question on US President Donald Trump’s threat of military action in Nigeria over alleged persecution of Christians.

She also reacted to reports that Venezuelan President Nicolás Maduro is seeking military equipment from China, Russia, and Iran to prepare for possible US attacks.

“China has a clear-cut stance on the US cracking down on so-called ‘drug cartels’ by force in the Caribbean Sea,” Mao said, stressing that China supports combating cross-border crimes through stronger international cooperation, not through threats or use of force.

She stated that, “We stand against moves that undermine peace and stability in Latin America and the Caribbean region, and oppose unilateral and excessive enforcement operations against other countries’ vessels.”

“We hope the US will engage in normal law enforcement and judicial cooperation through bilateral and multilateral legal frameworks,” she added.

On Saturday, Trump ordered the US Department of War to prepare for “possible action” in Nigeria, warning the Nigerian government to act swiftly to end what he described as the “killing of Christians.”

He labelled Nigeria a “disgraced country,” threatening to halt US aid and possibly take military action to “wipe out the Islamic terrorists” allegedly responsible for the violence.

Responding, President Bola Tinubu dismissed the claims, insisting that Nigeria remains committed to religious freedom.

“The characterisation of Nigeria as religiously intolerant does not reflect our national reality. Religious freedom and tolerance have been a core tenet of our collective identity and shall always remain so.”