KAYI Microfinance Bank: Empowering Tsangaya schools for economic transformation in Northern Nigeria

By Rabiu Alhassan Elkanawi

As Nigeria continues to champion financial inclusion and socio-economic development, KAYI Microfinance Bank has taken a decisive step to address the needs of remote communities through an initiative named Grassroots Empowerment and Engagement Project.

Recognising the unique challenges faced by Tsangaya (Almajiri) schools in Northern Nigeria, KAYI Bank has launched a pilot program across four states—Kano, Katsina, Kaduna, and Jigawa—targeting these centuries-old learning centres to boost financial literacy, entrepreneurial activities, and access to digital banking services.

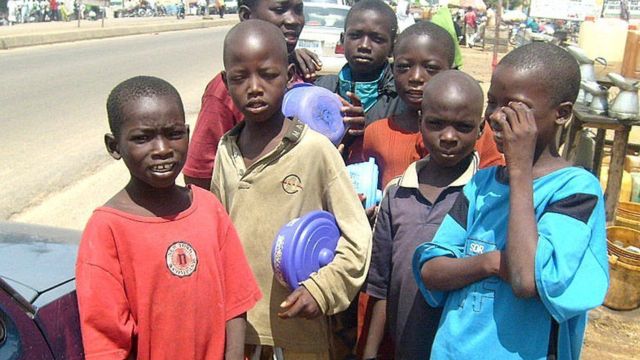

Tsangaya schools have traditionally offered Islamic knowledge, basic literacy, and numeracy skills, primarily in Arabic. Many of these centres are located in areas with little or no access to conventional banking facilities, leaving them vulnerable to financial exclusion. Poverty and unemployment continue to be rampant in these communities, where students (almajirai) often resort to street begging to meet their needs. This new program by KAYI Microfinance Bank directly tackles these issues by positioning Tsangaya instructors and leaders as community champions of digital financial inclusion and economic empowerment.

Piloted in August 2024, the program provides each participating Tsangaya school with a range of resources valued at about five million naira. This includes training sessions on financial literacy, business management, and start-up funds. These investments enable each school to establish and operate a cash point business, offering critical services such as deposits, withdrawals, and transfers. By eliminating the need for community residents to travel long distances to access banking, the initiative significantly cuts costs and eases residents’ financial transactions.

The empowering nature of this approach promotes trust in financial institutions. Community members can interact with familiar faces—teachers and leaders from the Tsangaya schools—who have undergone comprehensive training to provide financial literacy and other training to the community and effectively manage these cash points. Over time, the program will enhance economic engagement, stimulate local entrepreneurship, and help reduce poverty rates in historically underserved regions.

By placing financial tools within reach of marginalised populations, KAYI’s initiative offers a sustainable solution. Stakeholders, including students, parents, and local traders, gain firsthand exposure to the benefits of digital banking. Basic financial concepts—saving, budgeting, and prudent money management—are introduced in an environment that respects the community’s cultural norms and values.

This program’s potential extends beyond immediate monetary benefits. Supporting Tsangaya schools contributes to the broader goal of social development and community upliftment. If children have better prospects for skills acquisition and financial stability, fewer may be compelled to resort to street begging. Building trust and familiarity with digital banking services encourages more people to open savings accounts, apply for microloans, and engage in entrepreneurial endeavours.

KAYI Microfinance Bank’s efforts align with the broader objectives of financial inclusion strategies set by the Central Bank of Nigeria (CBN). With many remote regions in the North still lagging in access to credit and other essential banking products, the bank’s model provides a blueprint for how financial institutions can partner with local leaders to overcome distrust and logistical barriers. Further replication of this approach will likely spur economic activities, reduce unemployment, and help alleviate poverty.

As the pilot program continues, KAYI plans to monitor and measure outcomes to refine and expand the model. The ultimate goal is to replicate the initiative across more states in Northern Nigeria and beyond. The bank envisions a future where every region, no matter how remote, can participate actively in the digital financial system, thereby nurturing entrepreneurship and uplifting entire communities.

KAYI Microfinance Bank is a beacon of corporate social responsibility. By creating a culture of financial literacy among grassroots populations, the bank has set a high standard for other financial institutions to follow. By merging profit-driven objectives with a genuine commitment to social impact, the bank has created a virtuous cycle: stronger local economies, lower poverty rates, and a more inclusive financial ecosystem that can drive sustainable development across Nigeria.

Rabiu Alhassan Elkanawi writes from Kano, and he can be reached via email at alhassanelkanawi@gmail.com.