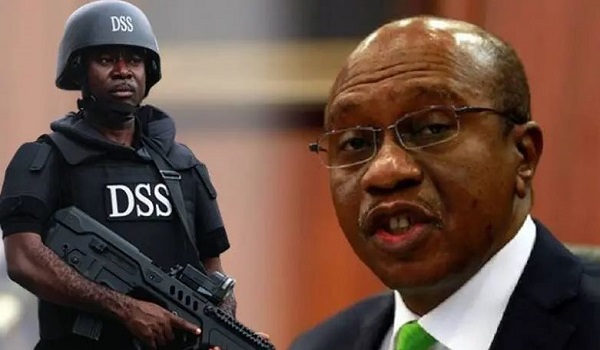

Hon. Kazaure has been vindicated, and it’s time to prosecute Emefiele

By Sani Bello Hamza Nigeria is a country naturally blessed with abundant resources, fine and reliable crude oil, thriving agriculture, resilient youth, and a hardworking population. Yet, its citizens are…