Defending the Naira: A political perspective

By Ibrahim Isa Wada

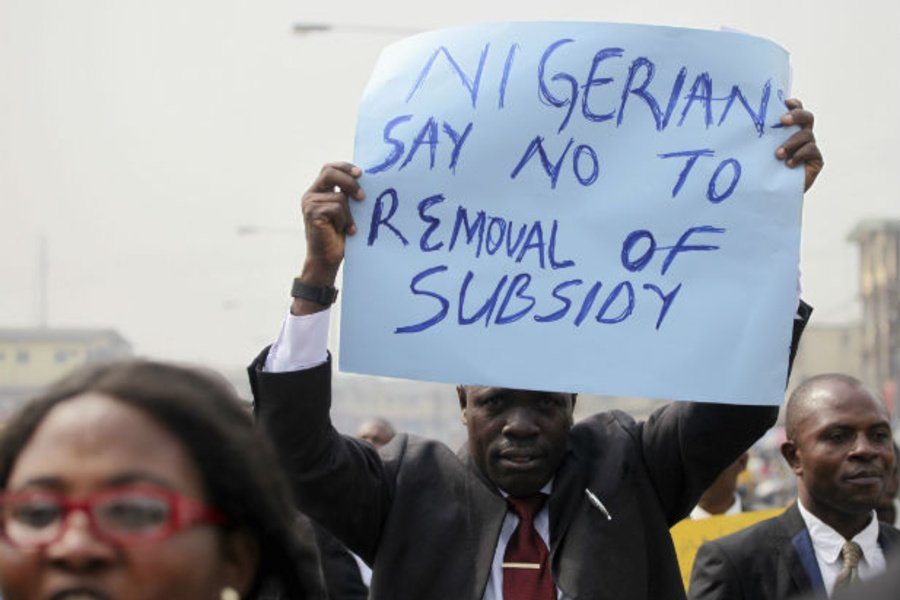

When the current administration was advised by some economic experts to withdraw the subsidy on fuel and allow the Nigerian Naira to find its own value in the international arena, I got so much worried for fears of what would be the outcome. Being a nonexpert on economics, banking or finance, but only a bloody retired broadcast regulator with a fair understanding of day to day current issues, I decided to drop this piece and I hope it will be carefully considered by the experts. All I know is that, life is so hard for all of us since the Naira decided to take a flung and the fuel prices shoot up.

Sadly, some of the experts disappeared while others started to blame the past administration and/or their village people for making our lives so miserable.

Defending the value of the Naira amounts to defending the Tinubu/Kashim administration, and surely the interest of the Nigerian people.

How can any government, businesses or persons successfully plan and execute meaningful projects; how can Nigeria join economic groups, like the BRICS, with such a rickety currency?

I understand that the value of the Nigerian Naira is a function of her balance of trade. That is for the Naira to be strong and stable, the total value of goods and services Nigeria imports must be the same or less than the value of goods and services Nigeria exports over the period of time.

In the present circumstances, we tend to import almost everything including PMS, and even charcoal for smoking Shisha! While we export gold and dollars in cash etc, to safe havens. To be frank, any Nigerian leadership that wants to succeed must have a strong and stable Naira to begin with, which can be achieved by taking the following measures, among others:

1) Bring back the policy of Export Promotion and Import Substitution of the late 70’s.

This should be done with vigour. Any product that could be manufactured in Nigeria shall not be easily imported into the country, while all products that can be exported should receive a boost from the government.

There are means and ways to manuver around international trade politics, like the WTO, to achieve that.

2) Formalise all international transactions, including our transborder trade with ECOWAS and other African countries. Currently the Nigerian Central Bank serves as the unofficial African Central Bank, providing the foreign exchange requirements for many African countries that route their trade through Nigeria.

The trade formalization entails the systemic deployment of adequate personnel and infrastructure that would make international trade between Nigeria and other countries smooth, yet documented.

3) The CBN, Commercial Banks and Bureau De Change operations should have a joint universal forex transactions software that will ease, unify and speed up forex trading.

4) From 3 above, all foreign currency transfers including PTA above $250 must be in digital form.

5) Also from 3 above, the commercial banks and BDC Forex Operator window should capture a basket of about seven major foreign currencies that Nigeria transacts in, i.e Dollar, Yuan, Euro, Pound, CFA, Saudi Riyal and Dirham.

Therefore the BDC operators should have multiple currency accounts with their banks to receive and transfer funds in digital form.

6) The Nigerian government should be bold enough to block all foreign exchange leakages, in form of waivers and favours to individuals and institutions.

7) Develop key institutions targeted towards the elimination of Forex Guzzlers thus:

a) Establish more private universities to reduce students high foreign exchange remittances.

b) Establish more world class hospitals to save foreign exchange from medical tourism.

c) Establish companies for the local fabrication of low technology agricultural and industrial machinery to reduce foreign exchange outflow.

d) Fuel imports should stop at the shortest possible time, by developing more modular refineries, privatising existing ones and ensuring the early take up of the Dangote refinery.

8) In line with the Export Promotion and Import Substitution Strategy, invest heavily in agriculture to reduce food and dairy products import, as well as encourage the exports of cocoa, cashew nuts, sesame seeds, beef, etc.

This is my political perspective of the basic economic issue, because if the politicians fail to defend the value of the Naira and the poor, they will fail utterly in politics.

Ibrahim Isa Wada, writes from Kano, Nigeria. He can be reached via; ibrahimisawada@gmail.com