The curious connection between money and relatives

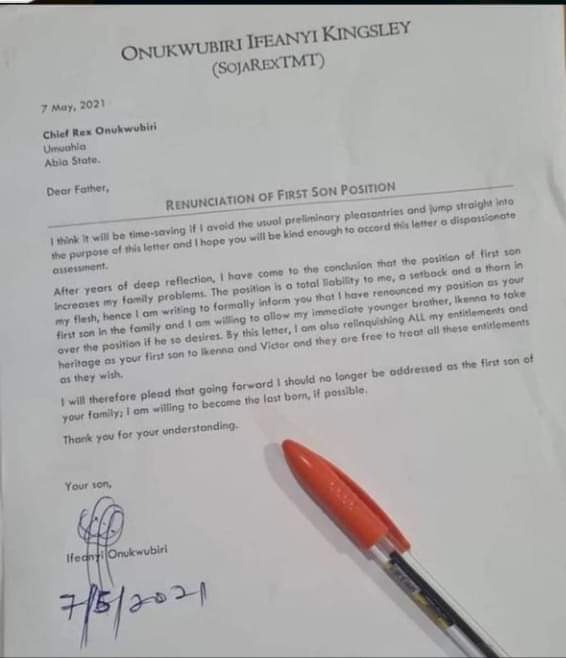

By Abdulrazak Mukhtar Money uniquely impacts family relationships, often leading to complex dynamics and a range of emotions. When individuals come into money, it can suddenly bring distant relatives to…